NCIGF 2022 Annual Report

Supporting the Insurance Promise

Indianapolis, Indiana

Overview

Bringing 2022 to completion in the midst of great waves of disruption throughout the property & casualty guaranty fund community further solidified NCIGF as the trusted experts in policyholder protection, insolvency management and member coordination. NCIGF members and stakeholders, calmly absorbed climate-driven insolvency spikes due to technology challenges and unprecedented public policy outcomes. The mission of NCIGF to bring value to its membership remained the focus throughout 2022 and the community has never been stronger, learning from the past and embracing fresh perspectives from new colleagues, challenges and situations.

New York CIty, NY

Our Vision

To be the definitive national leader on matters related to insolvency and its consequences to policyholders and claimants protected by the state-based property and casualty guaranty fund system.

Raleigh, NC 2022 Annual Conference

Our Mission

To bring the greatest possible value to the member state property & casualty guaranty funds and the state-based guaranty fund system in operational support, communications and public policy development.

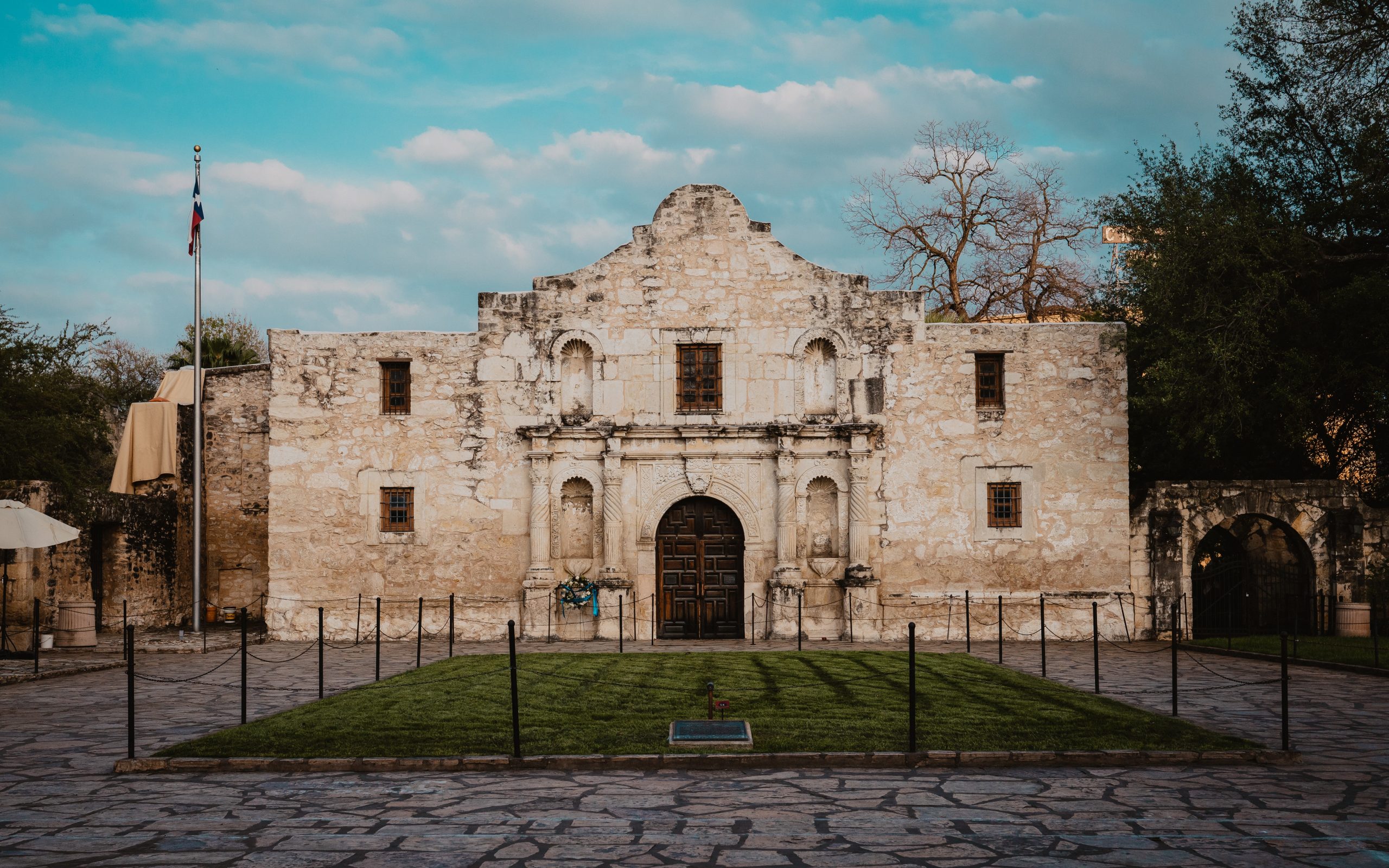

San Antonio, TX 2022 Fall Workshop

Key Accomplishments

Mitigating “Readiness Risk”: Guaranty funds have a rich history of adaptation and flexibility during those rare occasions when an insurance company becomes insolvent. As the insurance industry continues to evolve its technology and business practices and responds to public policy changes, the challenge for the guaranty funds to adapt grows steeper. NCIGF is amid a multi-year initiative to smooth the frictions that pose a threat to the ability to respond promptly to consumers.

Focus on Pre-liquidation Planning

- NCIGF continues to promote earlier pre-liquidation planning in various forums. Because of the need to transition data immediately when the guaranty funds are triggered and the complexity of products such as large deductible and cyber liability, this planning needs to begin before a formal insolvency proceeding is ordered. This year the “E” Committee at the NAIC adopted a pre-liquidation Memorandum of Understanding (MOU). It is now available on the RITF website for use by insolvency practitioners. Moreover, the MOU and accompanying revisions to various handbooks have been referred to NAIC working groups that address troubled company issues before a formal insolvency proceeding is commenced. We expect action on these referrals in 2023.

Restructured Business

- Statutes that authorize insurance company divisions or insurance business transfers (IBTs) continue to be adopted in various states, generating concerns about the status of guaranty fund coverage. The matter is particularly urgent in that both division statutes and IBTs make it clear that there is no remaining liability on the part of the transferring entity for the claims transferred under these statutes. The NCIGF Board of Directors adopted a position on this matter stating that if coverage existed on a claim before the restructuring transaction it should remain in place after the transaction. Conversely, if coverage was not available before the transaction it should not be created by the transaction. As many current guaranty fund laws may not resolve these claims in this way, NCIGF developed a statutory remedy. This remedy has been adopted in four states and efforts continue to promote the amendment in additional jurisdictions. Most recently a draft in this regard has been recommended to the Receivership and Insolvency Task Force (RITF) at the NAIC. The NAIC is in the process of reviewing this draft.

Cyber Security Insurance Coverage in Insolvency

- Cyber security insurance coverage in insolvency is an evolving issue. No specific policy forms have thus far been developed to address these risks. Moreover, the policies provide notification, remediation, and forensic services along with claim payments. Response time to provide such services is often quite short. Should an entity that covers these risks become insolvent and be ordered into liquidation the guaranty funds would be called upon to act. The NCIGF has developed statutory language in this regard and will be implementing educational programs for our own member community, industry groups and organizations such as the NAIC. Thus far amendments to adopt cyber liability revisions to the guaranty fund act have been adopted in California and are pending in Illinois and Massachusetts. A draft change to the NAIC model property casualty guaranty fund act has also been presented to the RITF. We expect the NAIC review of this draft to commence in the near future.

NCIGF Tabletop Exercise

- A “tabletop” exercise was conducted at the NCIGF Fall Workshop. During this exercise participants discussed various procedures that would need to be implemented with regulators prior to a formal liquidation process and troubleshot the various challenges that might arise in this context. At this point the Innovations and Operations Committee will undertake various projects related to needs identified in this exercise and has made referrals to other NCIGF committees.

Pre-Liquidation Table Top with Regulators and Receivers

- Regulators have expressed special interest in conducting a “tabletop” exercise on pre-liquidation planning similar to those conducted by NCIGF and NOLHGA in 2022.

Member Service, Technology & Headquarters Upgrades:

NCIGF Staff and Culture Updates

- Although NCIGF has always had a strong emphasis on culture and overall staff health, with the addition of several new staff members in 2022, NCIGF made staff culture and overall staff satisfaction a top priority. These efforts included accountability for executive staff to incorporate more comprehensive review processes for the staff they manage, the utilization of eSources to train and do staff development exercises with the team, updating of the NCIGF Shared Values to include a value highlighting Diversity, Equity & Inclusion as well as including a Diversity, Equity & Inclusion Statement on the NCIGF public site, and a plan to provide new ways to develop staff culture into the future.

IT Core Services Upgrade

- NCIGF staff made critical updates to the organization’s widely used UDS Data Mapper (www.udsdatamapper.com), including bug fixes, implementation of new features, and critical internal updates needed to facilitate and accelerate future development and growth of the application.

MemberConnect Upgrade

- The association’s member communication and collaboration hub were successfully migrated to a new cloud platform, Confluence Cloud. Using this “buy vs build” approach resulted in accelerated migration to the new platform as well as considerable cost-savings over an in-house development approach.

NCIGF Technology Issue Tracking and Productivity Enhancements

- NCIGF added a new ticketing system for submission and tracking of support requests from members, internal staff, and GSI clients. The system allows for self-service request reporting if desired and tracking of the complete history of individual requests from start-to-finish. Over time, the body of knowledge built from tracked requests is becoming an asset that enables staff to resolve recurring issues more quickly.

New Support Options for NCIGF Members

- In conjunction with the issue tracking system, NCIGF introduced a new service request portal for GSI clients and NCIGF members that provides greater ease of requesting services, and more control and visibility into the status of open support requests.

Improved Software Development Pipeline

- NCIGF technology staff implemented the Continuous Integration / Continuous Deployment (CI/CD) methodology for software development. This widely used approach to the automation of building, testing and delivery of software results in fewer defects and faster delivery of quality software applications by our software engineering team.

Successful External Cybersecurity Testing

- NCIGF engaged a cybersecurity firm to conduct internal and external penetration tests, both of which were passed successfully.

Response to Covid-19

- In the ongoing response to COVID-19, NCIGF continued to leverage virtual platforms for continual educational sessions between in-person events. These events will continue in tandem with in-person meetings to allow for the participation of support staff members throughout the country who have been able to participate and connect at a higher level with the virtual option (specifically claims, IT and HR personnel). 2022 also saw NCIGF hosting hybrid events for the board members and managers who may still have been unable to travel or were dealing with any restrictions from their companies. Due to budgetary restrictions, future planning will include mostly in-person events for large gatherings and board meetings.

2021 – 2022 NCIGF Board of Directors

Chad G. Anderson

Chair

President

Western Guaranty Fund Services

Joseph Torti III

Vice Chair

Vice President – Regulatory Affairs

Fairfax Inc.

Arthur M. Russell

Executive Director

Mississippi Insurance Guaranty Association

Chad E. Wilson

Associate Vice President, Government Relations

Nationwide Insurance

Jenny L. Anzalone-Ackley

Deputy Director, Assessments and Guaranty Fund Reporting

Chubb NA Office of General Counsel

Katherine J. Evans

Vice President of Regulatory & Government Affairs

CSAA Insurance Group

Tamara W. Kopp

Executive Director

Missouri Property & Casualty Insurance Guaranty Association

Robert L. Zeman

Coporate Counsel

Allstate Insurance

Barbara Peterson Law

President & CEO

Guaranty Fund Management, Inc.

Christopher P. Roe

Senior Vice President Corporate and Government Affairs

CUNA Mutual Group

J. Smith “Smitty” Harrison

Executive Director/Secretary

South Carolina Property & Casualty Insurance Guaranty Association

John C. Wells

Executive Director

Louisiana Insurance Guaranty Association

Larry E. Hinton

Senior Counsel

GEICO

Timothy M. Schotke

Executive Director

Illinois Insurance Guaranty Fund

LaVawn D. Coleman

EVP, Chief Legal Officer, and Corporate Secretary

Grange Insurance

Bradley A. Roeber

Executive Director

California Insurance Guarantee Association

D. Keith Bell

Senior Vice President, Corporate Finance

The Travelers Companies, Inc.

Joyce Hall Mellinger

Senior Vice President and Associate General Counsel

Zurich North America

Michael D. Boge

State Counsel Section, Corporate Law

State Farm Insurance Companies

William M. Lynch

Vice President & Chief State & Local Affairs Officer, Public Affairs

Liberty Mutual Insurance Company

Andrea C. Lentine

Executive Director

Alabama Insurance Guaranty Association

2022 NCIGF Staff

*Resigned in 2022

Roger H. Schmelzer

President & CEO

Michael J. Ulmer

Vice President, Technology Services and Operations

Ashley N. Rosenberger

Senior Legal Counsel & Corporate Secretary

Robin J. Webb-Reus

Director of Communications, Engagement & Culture

Lynn Cantin

Meeting Planner

Richard L. Minnear

Lead Systems Engineer

Amy J. Clark

Vice President & CFO, Director of Association Business Operations & Treasurer

Barbara F. Cox

Consultant – Legal & Regulatory Affairs

Douglas P. Storz

Lead Programmer

Emily M. Jurey

Executive & Communications Assistant

Nate T. Jennings

Software Engineer

Kevin C. Leap

Manager of Accounting and Administration

Connor B. Inman

Business Systems Analyst

Paul K. Joy

Full Stack Developer

Anna L. Berndt

Junior Software Engineer

Minh-Tri A. Dang

Communications Assistant

Katherine D. Bender

Luke K. Brown

Junior Software Engineer

*John Blatt

General Counsel, Director of IT Strategies & Corporate Secretary

*Jeremy A. Sebring

Director of IT Services